tax saver plan in post office

Individuals can open post office savings account for their children and earn interest at a rate of 4 to nearly 7 annually. Regardless of any other related parameters the post office saving schemes are government-backed and therefore are the safest and risk-free investment.

Post Office Schemes Good Income No Risk Tax Incentives 3 Punch Post Office Schemes These Three Post Office Small Savings Schemes Offer Higher Returns Safe Investment And Tax Benefits Time News

Features of Post Office Savings Account.

. Post Office Savings Account SB Interest payable Rates Periodicity etc. 5-Year Post Office Recurring Deposit Account RD 580. The 5-year Post Office FD or National Savings Term Deposit is eligible for a tax deduction under section 80C of the Income Tax Act 1961.

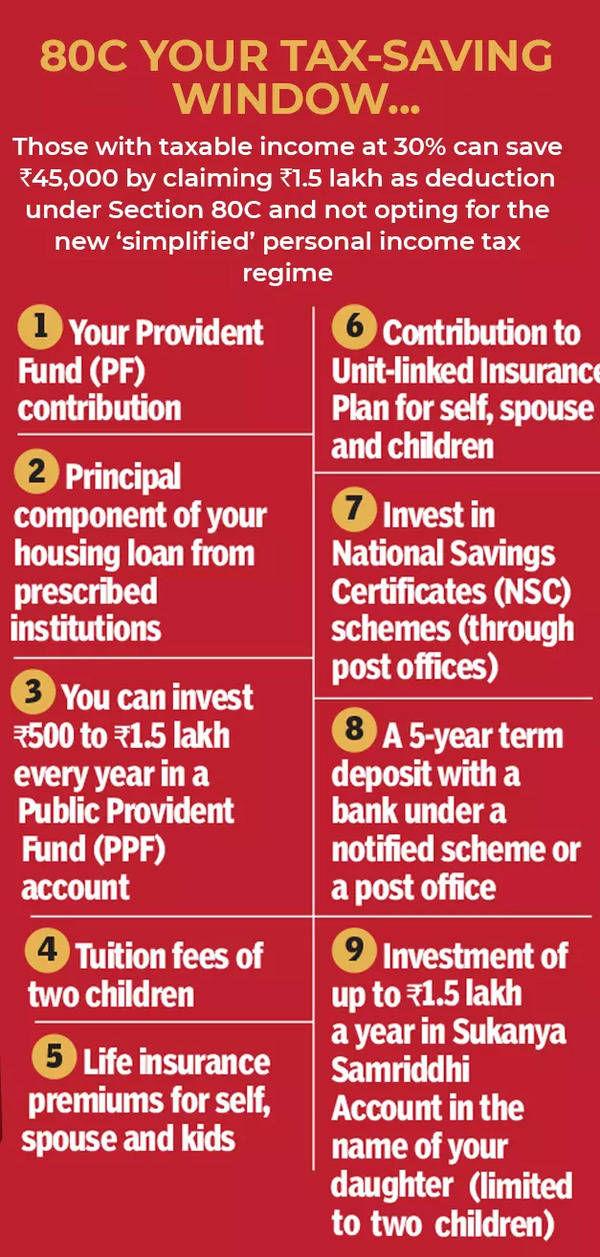

Its safer than equity investments in terms of risk and returns. Post Office Time Deposit Account TD. Following post office schemes qualify for tax exemption under Section 80C of the Income Tax Act 1961.

In addition we take pride in our ability. Post Office Savings Account. Visit the closest post office.

Section 80C of the Income Tax Act 1961 provides a. Welcome to TaxSaver Plan. The investment under 5 Years TD is qualified for the benefit of Section 80C of the Income Tax Act 1961 from 1st April 2007.

The following steps can enable you to easily apply for a post office saving scheme4. Names of PO Tax saving Schemes. Below are some of the features of a tax-saving.

10 rows Process to Apply for a Savings Scheme in Post Office. Rs 250 to Rs 15 lakh. The post office scheme which has a maturity of 5 years offers an interest rate of 68 compounded annually but payable at maturity.

Vist the closest post office branch. Risk-free and Reliable Investment. The banks decide the interest rates and it depends on several factors.

4 per annum pa 20 and 50 non-cheque facility No limit. 5 Year Post Office Time Deposit POTD Senior Citizen Savings Scheme. How to Apply for a Post Office Saving Scheme.

Post office Savings Account. Interest with no tax up. Under section 80TTA interest income earned from savings account up to Rs10000 is tax deductible from the gross income.

Post Office Savings Scheme Type. Post Office Monthly Income Savings Account MIS. Resident Indians both major and minor.

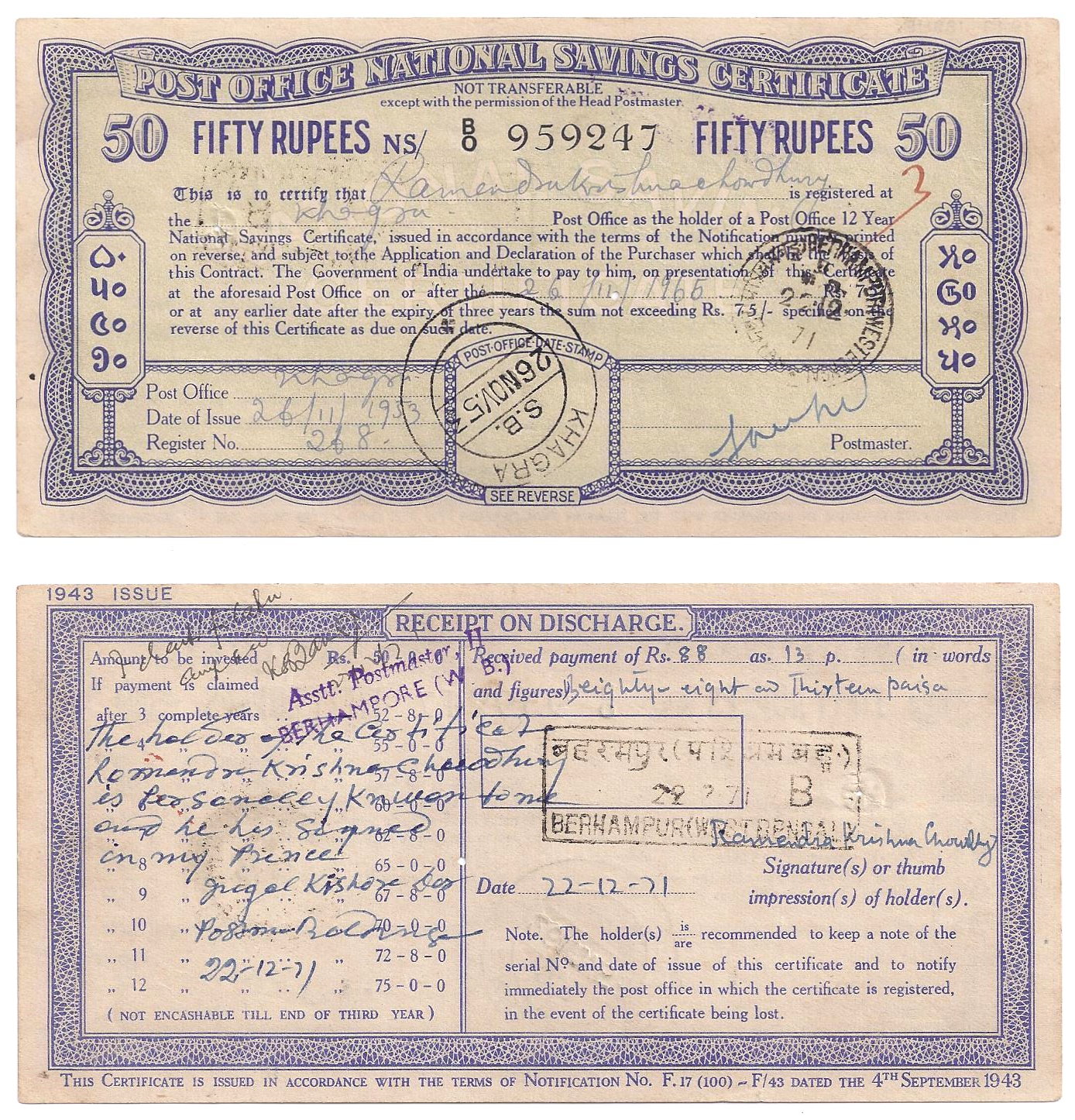

Deposits in the NSC also qualify for. Minimum Amount for opening of account and maximum balance that can be. Post Office Savings Scheme Taxability.

We are a business that firmly believes in hard work integrity compliance and commitment to customer satisfaction. Post Office Savings Account SB. If you open a fixed deposit with the post.

Investment up to Rs 150000 is exempted from tax under section 80C of the. Now let us take you through the easy steps of applying for any of the post office saving schemes listed below. Any parent or a guardian can make deposits based on the potential.

Post Office Savings Account.

Post Office Scheme Invest Rs 25 000 And Earn Up To Rs 21 Lakh Know How

Union Budget 2022 Your Tax Saving Window Section 80c And Beyond Times Of India

A Detailed Comparison Between Various Saving Schemes

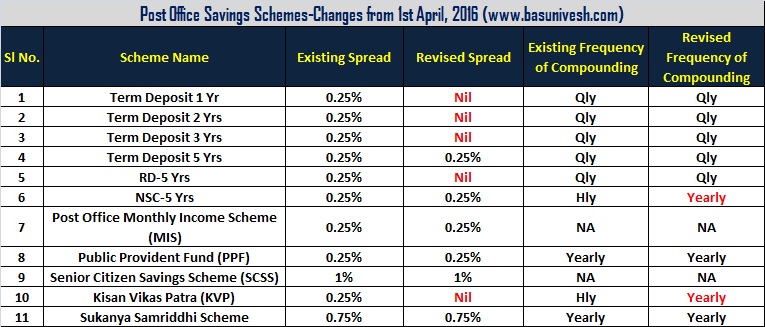

Post Office Savings Schemes Changes Effective From 1st April 2016 Basunivesh

National Savings Certificates India Wikipedia

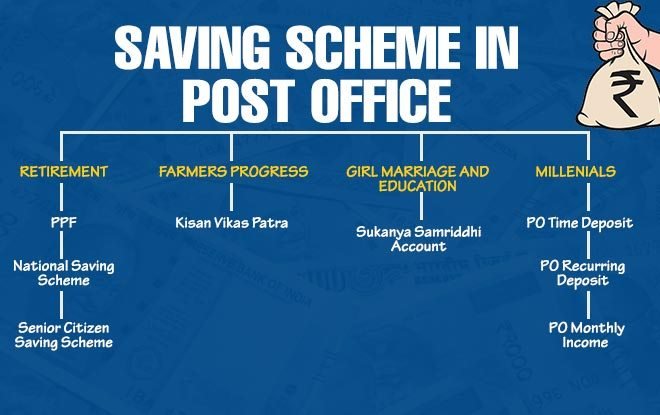

Post Office Small Saving Schemes In India Fintrakk

9 Post Office Savings Schemes Offered By India Post By Aradhana Gotur Tickertape Medium

Public Provident Fund Vs Scss Vs Nsc Vs Ssy These Post Office Tax Saving Schemes Beat Ppf The Financial Express

Savings In Post Office Are They Really Worth It Investify In

List Of Post Office Tax Saving Schemes Indianmoney

Factors Influencing The Parents To Invest In Post Office Saving Scheme Download Scientific Diagram

What Is The Best Post Office Plan For A Boy Child Quora

Tax Saving Schemes Of Post Office Postoffice Youtube

Post Office Time Deposit Helps To Save Tax Comparepolicy Com

5 Post Office Saving Schemes To Invest In For Better Income Tax Benefits Zee Business

Do You Know Why Post Office Savings Is Better Than Bank Trendingindia

4 Best Post Office Saving Schemes Interest Rate And Eligibility Paybima

Senior Citizen Saving Scheme Scss In Tamil Post Office Savings Scheme Tax Details Explained Senior Citizen Investing Schemes

Post Office Saving Scheme 2021 Ppf Nsc Fd Rd Mis Interest Rate